Here are some examples of very important insurance coverage :

Health insurance (Krankenversicherung)

Public Insurance

Private Insurance

Third party Liability Insurance (Haftpflichtversicherung)

Home Insurance (Hausratversicherung)

Legal Assistance or Legal Aid Insurance (Rechtsschutzversicherung)

Accidental Death Insurance or Disablement (Unfallversicherung)

Life Insurance (Risikolebensversicherung)

Yearly Travel Insurance (Reiseversicherung)

Vehicle Insurance (Kfz-Haftpflichtversicherung)

Health insurance (Krankenversicherung):

Health Insurance is one of the things that is mandatory in Germany.Germany provides you with the best healthcare opportunities. More than 85% of the population uses public health insurance, while others opt for private ones. So Insurance is mandatory for everybody. Especially for students Insurance becomes the first step towards an enrolment. Further to add as German Medication, doctors and hospitals are usually very expensive so one must assure to take care of emergencies and sickness via Insurance. While passing the visa procedure insurance is a must, Residence permits won’t be issued without a valid Insurance. Every people in German, or employees of a German company are entitled to have an Insurance by default.

Germany provides you with three options in healthcare system.

Public Insurance(Gesetzliche Krankenversicherung)GKV or German national health insurance.

Private Insurance (Private Krankenversicherung) PKV.

combination of both.

For health insurance, you have a choice among several private insurance companies and a national health insurance program. Your employers usually pay half of the premium. Your company is responsible for completing the necessary formalities, and once this is done a health insurance card (Versicherten Karte) is issued. Every time you apply for benefits or seek reimbursement, you must have this card. With this card you can visit general practitioners and specialists without paying any fee.

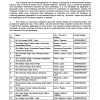

The difference between mandatory national insurance and private insurance are as under :

The first and most visible difference is the way premiums are set. In national insurance they are based on your salary, while private insurance premiums are based on your age at entry, gender and pre-existing conditions.

Private insurance premiums can be lowered if you elect to pay your minor medical expenses yourself, up to an agreed annual sum. Persons putting in no claims in a year can get up to five month’s premiums refunded.

Government insurance is recognized throughout Europe, whereas most private insurance benefits stop at the border or, at best, are limited when you are abroad. You can, however, get travel health insurance (Reisenkrankenversicherung) protecting you abroad.

Public Insurance:

In Public Insurance there are around 100 state companies. While the major and popular players are Barmer, AOK andT.K(Technicker Krankenkasse). Normally employees whose regular income is Up to a gross salary of 50,850 Euros annually are subjected to have a Public Insurance. For students who are single and over the age of 23 are subjected to pay an amount of 77.90 Euros per month towards Public Insurance. For example if one falls under the category of paying Public Insurance he/she is entitled to pay a maximum of 700 Euros as a monthly premium. So your contribution is approximately 373 Euros and the employer is entitled to pay 327 Euros. Minimum membership is of 18 months. With Public Insurance one has to pay 10 Euros per quarter in cash until the first appointment of the doctor, this 10 Euros is valid for treated by every kind of doctor except a dentist. For services of a Dentist one has to pay 10 Eurosagain(quartely). In a hospital care one has to pay a fee of Euros 10/Day for a maximum of 28 days. One has to pay 10% for the cost of drugs and dressings, which averages from 5 Eur to 10 Eur.

Private Insurance :

Generally Private Insurance has more geographical coverage. And by having a private Insurance there are more chances of getting personalized services in terms of language or facility. Usually people who are self employed or are in the higher income bracket opt for Private Insurance. But Almost everyone can join a Private Insurance. Previously private insurance was considered a less effective option than a public one, as it was more expensive. But Nowadays private insurances seems to be covering the market in a fast pace. The total cost of the Insurance varies according to the benefits needed. Normally Private ones seems to be good for Expatriates as one can figure out their own plan and eventually end on paying less than German Public Insurance. Moreover doctors earn more while treating a private insurance customer, as a matter of fact one can ensure good facilities at the time of treatment. There are more than 40 Private Insurance companies in the German market. For Student it starts from 35 Euros a month and an employee might end up paying 150 Euros. Another advantage would be of not paying the additional payments for medicines and treatments as in Public Insurance.

Here we list some of the abbreviations which might help you in initial visits with your doctor.

English

German

antibiotics

Antibiotika

ambulance

Der Krankenwagen

backache

Die Rueckenschmerzen

blood test

Eine Blutprobe

blister, bladder

Die Blase

blood pressure

Der Blutdruck

bone

Der Knocken

breath

Der Atem

(to breathe)

atmen

broken

gebrochen

chickenpox

Die Windpocken

concussion

Die Gehirnerschuetterung

constipation

Die Verstopfung

contagious

ansteckend

cough

Der Husten

old (in the head)

Der Schnupfen

contraceptive

Das Verhuetungsmittel

diabetic

Der/ Die Diabetiker(in)

depression

Die Depression

diarrhoea

Der Durchfall

dizzy

schwindlig

inflamed

entzuendet

faint

schwach

fever

Das Fieber

headaches

Die Kopfschmerzen

to become infected

sichentzuenden

injured

verletzt

insulin

Insulin

in vitro fertilization

In- Vitro-Fertilization

joint

Das Gelenk

migraine

Die Migrane

muscle

Der Muskel

muscle pains

Die Muskelschmerzen

nauseous

uebel

nurse

Die Krankenschwester

pain

Der Schmerz

pregnant

schwanger

prescription

Das Rezept

unconscious

bewusstlos

vomit

Das Erbrechen

weak

schwach

We wish you Gesundheit(Bless you) for your health.

Third party Liability Insurance (Haftpflichtversicherung):

A least expensive option but also the most important one. This Insurance helps to pay the loss or damage caused by one’s fault. It gives you an extensive coverage facility. The Insurance protects you if you cause injury or death of a person due to negligence or by accident, that might cost you lot of money. But this Insurance will make a way out for you. According to the German law, there are no limits for being awarded in such kind of Insurance, as accidents may occur up to any extent. Usually these type of Insurance have policies of upto 3 or 5 years contract. One must always opt out for the least period and the most inexpensive policy. Please Be aware that for Vehicle and Dogs you need to take different Insurance policies. It start from paying a nominal fee of 45 Euros a year. For students they can even reduce the rates by negotiating with the Insurance company if they agree on deductions for small part of the losses. Students can also check whether they are being insured in their home country or by their parents for third party Insurance.

Home Insurance (Hausratversicherung):

It is essential for covering loss or damage to your possessions(Household Contents). Fixtures and fittings attached in the building are excluded from such kind of Insurance. Things included are such as furniture that you’ve purchased,clothing, collectibles, computers, valuable belongings etc. The coverage of this Insurance includes water damages, earthquakes, storms, lightning, stock against fire, explosions, theft or burglary and vandalism. Premiums of such Insurance depends upon where you live, cost of your belongings or possession and the benefits you need. Again one must be careful while getting into a contract, as the longer contract you are in higher the agents are paid.

Legal Assistance or Legal Aid Insurance (Rechtsschutzversicherung):

This type of Insurance might help you to save lot of money and personal discomfort. Whether you have tax disputes, Misunderstanding with employer or landlords, neighbour problems or accidents. This Insurance ensures to protect your rights and save your money without knowing you will win the case or when your legal expenses will be recovered. For those who cannot take the risk of going to court, especially when they are not well versed with the language, this Insurance helps to save a lot in such cases. It varnishes all your cost till trial except fines imposed. It also covers the costs of lawyer, expert witnesses, court fees(legal expenses) and if you are defeated in the case the cost of opposite party. Divorces are not included, and specialized policies are offered to top level employees and self employed people. These type of Insurances are highly customized accordingly, and one must take out this kind of Insurance only when the risk is higher than the average.

Accidental Death Insurance or Disablement (Unfallversicherung):

This kind of policy usually pays a lump sum amount for the accident occurred. Death is self explained, but in case of total loss of body parts this Insurance is essential. Such kind of Insurances also covers if a child intakes a poisonous substance. This Insurance also benefits in Disablement, but only when it is caused by accident. Occupational disability or critical illness cannot be claimed in such kind of Insurance.

Life Insurance (Risikolebensversicherung):

It is an inexpensive Insurance form which depends upon the starting period of the insurance, age of the insured and the medical record. It depends on personal decisions one must make while taking out this kind of Insurance. But it also serves as an investment or an addition to the pension. There are varieties in policies and tariffs. Therefore it is recommended to consult an expert before carrying out the Insurance. For the people who are already having a similar one in their home country must confirm about the validity of it in Germany.

Yearly Travel Insurance (Reiseversicherung):

This type of Insurance eradicates the hassle of buying a policy repeatedly on each journey. One can travel as much as they want globally, except some of the war zones. One must keep in mind about the duration of the trips which normally lies between 30 to 45 days. But one can even extend it by informing the Insurance company in advance. The Travel Insurance covers refunding of cancellation fees which is occurred by disability of travelling due to an accident, the curtailment fees which occurs if one cannot complete the trip on schedule, Medical expenses due to illnessabroad(yearly travel insurance is strongly recommended if a person is enrolled in Public Insurance), theft or robbery of your luggage or possessions and even the damages if caused during the transit.

Vehicle Insurance (Kfz-Haftpflichtversicherung):

Prior to the registration of a car, one is liable to have a third party Insurance. Self damages can also be covered in Vehicle Insurance(Teilkasko/Vollkasko). The prices depends upon various factors such as Beginners pay more than experienced one, the one who drives more powerful and big mean machines have to pay more in compare to the modest car owners, urban area inhabitants pay more than the rural ones and most important is the driving record, the one with bad driving record will end up paying huge amounts. If somebody has a good driving record in their home country, one may use the reference of previous insurer, this might help in lowering the cost of Insurance.

We wish you Gute Fahrt(Good Drive).

Here are some abbreviations that might help you in the world of Insurance.

German

English

Abmeldung

deregistration

Angehörige

dependents

Antragsfrist

deadline for application

Beitrag

premium

Beitragsrückerstattung

reimbursement of premiums

Bezugsberechtigter

beneficiary

Berufshaftpflicht

professional indemnity insurance

Betriebskrankenkasse (BKK)

company health insurance fund

Freibeträge

exemptions

Freiwillige versicherung

voluntary insurance

Gesetzliche Krankenkasse

statutory health insurance fund

Gruppenversicherung

group insurance

Haftpflichtversicherung

liability insurance

Hausratversicherung

insurance for household items

Karenzzeit

waiting period

Krankenhausbehandlungen

hospital care

Krankenschein

physician’s sick notice

Krankentagegeld

daily sick pay

Krankenversicherung

health insurance

Lebensversicherung

life insurance

Leistung

benefit

Mietrechtsschutz

legal rent protection

Pflegeversicherung

long term nursing care insurance

Pflichtmitglied

compulsory member

Prämie

premium

Rechtsschutzversicherung

legal protection insurance

Reiseversicherungen

travel insurance

Rückversicherung

reinsurance

Selbstbeteiligung

coinsurance or deductible

Unfallversicherung

accident insurance

Versicherungsmakler

insurance broker (represents the client)

Versicherungsvertreter

insurance agent (represents the insurance company)

Vollversicherung

comprehensive insurance

Usefull links:

http://www.tk.de

http://www.aok.dk/

http://www.mawista.com

http://www.deutscherring.de/

http://www.dkv.com

http://www.integraglobal.com/

http://insure-invest.de/

http://www.crcie.com

http://www.allianz.com.au/

http://www.sbk.org/

http://www.care-concept.de/

http://europa.eu/legislation_summaries/institutional_affairs/treaties/lisbon_treaty/ai0020_en.htm

http://www.divalsafety.com/

http://www.ce-expat.com/