Banking in Germany isn’t all that different from your home country bank but there are a few twists. Nowadays Banks are one of the most important institutions for our day to day life. There are more than 2600 commercial banks which has over 45000 branches all over Germany. The major players known in this Business are Deutsche Bank, Commerzbank,Hypovereinsbank, Postbank, Sparkasse and Targo bank. If you are looking forward to stay here for a while, then we strongly recommend you to open a bank account, as most of the institutions will accept only bank transfers including your housing authorities. Starting the use of banking services doesn’t need a lot of stress in Germany, you only need your Passport, proof of residence in Germany and initial amount to deposit. For students, some banks can even start your account with zero balance. If you are transferring funds(Overdraft) from your home bank, then you might need couple of weeks for the amount to be credited into your account. Usually banks provide you with EC(Euro card) card which is more popular than any means of payment and recognized almost everywhere. ATM’s are called asGeldautomat. Banks here are far more secure and forward in online banking. Pins are issued for ATM’s whereas TAN list are issued for online banking. Banks in Germany are universal, they offer customers various ranges in financial services beyond lending and depositing.

The cost to maintain an account should be investigated with each individual bank, when you are setting up your German banking accounts. Most banks charge a monthly fee, but others are free. You’ll find a one-time fee for some transactions. If you are a student or are on a fixed income, you will often get a free account.

You can have following types of account in Germany :

Girokonto (Current Account)

Sparkonto (Savings Account)

Spar Buch / Spar card

Depotkonto

VWL

Girokonto (Current Account)

Most of the people in Germany uses this type of account, as it is essential for most of the financial transactions. Previously most of the banks were charging monthly maintenance fees for this type of account. But nowadays this scenario has changed a lot, but still some of the banks charge it, and this may be somewhere around 10 Euros a month. So before opening this type of account, please crosscheck about the maintenance or annual charges for using the account. Some banks might agree upon waiving the maintenance charges if you agree upon having a minimum balance in your account. Some of the banks have tied up with other banks in order to provide the customer a facility of withdrawing from partnered bank’s ATM’s. Transferring amounts from such a bank accounts to any other EU country through SEPA(Single European Payment Area) is free. Moreover banks who has agreements with banks in another country outside EU also allows to transfer funds free of cost. For International transfers the account holders must be aware of using IBAN number and SWIFT code. The interest rates on such bank accounts are very low, ranging from 0 to 0.5 % annually. One can even establish a line of credit in such a bank account, in other words it may be known as overdraft facility (Dispo kredit). Depending upon your monthly income you can withdraw two or three times more. But please be aware of the heavy interest rates charged which may be between 14 to 18% annually. One must ensure for a hassle free customer service if you are a non-native speaker.

To open a Girokonto, you need the following:

passport

letter or contract of employment from your employer

Salary slip (if applicable)

reference from your home bank (only if you are applying for overdraft, credit, loan etc.)

if you wish other persons to have access, they have to be present as well

What you will get ?

Eurocheque card (popularly called as ec-card) for cash withdrawal from any bank (within all of Europe) and for payments in a shop, gas station, supermarket etc. displaying the ec-cash sign. If you have a joint account, you can also get an additional ec-card but mention this at the time of opening the account.

Eurocheques for payments up to DM 400,- in connection with ec-card. But you have to ask for it.

Credit card (Visa, Eurocard), if requested

Overdraft facilty :

Some banks allows to you make an overdraft withdrawal from your account for emergeny needs. However, they will charge you a heavy interest for this overdraft. The limit of overdraft depends on your regular income.

Once you have opened girokonto account, you can provide following account information to your employer, so that salary will be credit to this account.

Account Number.

BLZ – This is unique code of bank where you have your account.

Note: Your bank statements are required for tax return and other purposes in future, so download your bank statements in pdf format every month/quarter and keep them safe for future reference. These account statements will not be available online afterwards.

There are several alternate ways of making payments in Germany:

Transfer (Überweisung):

It is used to transfer money from one account to another. You fill in a transfer form (Überweisungsformular) available at your bank or use ATM (kunden terminal) for this purpose. This can be done online or with a paper form. You have tomention :

Recipient (Empfanger)

Recipient account number (Kontonummer)

Name and code number (Name und Sitz des Kreditinstitutes)

Amount (Betrag)

Standing order payment – common for rent (Dauerauftrag) :

It is used if you have regularly recurring payments of a set sum, such as rent, insurance premiums, television fees and the like This sum is deducted automatically from your account on an agreed date and transferred to the account of the recipient. The necessary forms can be filled out online or at the bank.

Direct debit-withdrawal authorization (Lastschrift):

This is a practical method if you have recurring payments that vary in size, such as the telephone, gas and electric bills. You give the recipient a direct debit authorization (Einzugsermächtigung) which authorizes it to deduct the respective amounts from your account. Of course, you can always cancel the authorization and stop the direct debit. As a safeguard against abuse you also have the unrestricted right for 90 days to recall any sum that was deducted in this manner. You can recall it even if it was proper, though this would give it the status of an unpaid bill.

Sparkonto (Savings Account)

A savings account is for saving your extra money, putting money aside. It is the similar savings account which you get in your home country as well. Depending on the account conditions, one can withdraw money anonymously or can wait for a maturity date. Banks interest rates varies from 0.25% to 3% per annum. Additional financial services such as direct debit, standing orders etc might not be available in savings accounts depending upon the conditions of the bank.

Spar Buch / Spar Card

If you are looking for an account like an Indian savings account, then open Spar Buch or Spar Card account with your bank. You will get a Passbook or an ATM card. You don’t have to pay for the account and you will get approx. 1% interest on your money.

The transfer to/from Girokonto is free of charge and you can also give a Dauerauftrag (standing order) for a regular transfer. However, all the transfer to/from this account are to be manually made by the bank.

TIP: You should give a standing order to your bank to transfer all your money from Girokonto to this savings account on a date 2-3 days before regular deposit date of your salary.

Depotkonto

This is an account to handle your transaction in the share market. You are required to pay annual fee (approx. 30 DM) to maintain this account. Also, every transaction is subject to a nominal charge.

VWL (Vermögenswirksame Leistung)

German government gives you some money every month to save for a purpose. With this money, you can open an account called VWL with a bank or other institutes. The account can be opened to buy mutual funds, fixed deposit orBausparkonto (to get a loan for buying a house) etc. etc. Though amount paid by the government is limited to DM 52,-per month, you are allowed to open the account for DM 52,- or DM 78,-. Of course, the additional amount is to be paid by you.

To open an account, you have to make a contract with the bank and give information about your employer. The bank will in turn inform your employer with the details of your account. The transaction will reflect in your monthly salary statement.

But don’t forget :

To open an account, you have to be at least 6 months in the company.

Tax will be deducted on this income.

The money is blocked for 6-7 years.

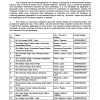

Hereby we list some of the useful terms which might be helpful in interaction with financial institutions.

Usefull links:

https://www.targobank.de/

https://www.deutsche-bank.de/

http://www.sparkasse.de/

https://www.commerzbank.com/