The real test of reform is whether it reduces stress for people—and 2025 marked a clear shift in that direction. Governance reforms focused on outcomes, not complexity, making everyday interactions with the system simpler and more predictable.

Simpler tax laws, faster dispute resolution, modern labour codes, and decriminalised compliance have reduced friction for citizens and businesses alike. The emphasis has been on trust, transparency, and long-term growth—showing how well-designed policy can quietly improve daily life.

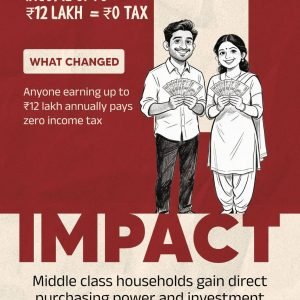

For millions of Indians, tax relief became tangible. Incomes up to ₹12 lakh now attract zero tax, enabling middle-class families to retain more of what they earn and plan their spending, saving, and investments with greater confidence.

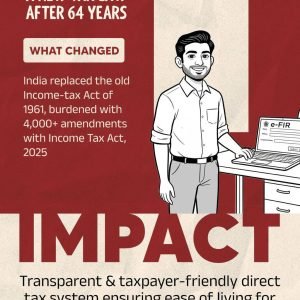

A new tax law for a New India: the Income Tax Act, 2025, replacing the Income-tax Act, 1961, streamlines compliance and brings clarity, fairness, and transparency to the direct tax system—making it more taxpayer-friendly and aligned with today’s needs.

Small businesses also stand to gain. Higher investment and turnover limits allow MSMEs to grow without losing benefits, encouraging expansion, job creation, and stronger local enterprises.

SOURCE OF LINK ; https://www.facebook.com/photo?fbid=1190955493189158&set=pcb.1190955593189148